“How long will my hail insurance claim take?” If you’ve ever asked this after a devastating storm, you’re not alone. Spoiler: The approval timeline can feel as unpredictable as the weather itself. But what if we told you there’s a roadmap through this chaos?

In this post, we’ll break down why your hail insurance claims may be dragging on and provide actionable steps to speed up the Approval Timeline. You’ll learn:

- The surprising reasons behind delays.

- A step-by-step guide to navigating the process efficiently.

- Secret tips from industry insiders for faster results.

Table of Contents

- Key Takeaways

- Why Does the Approval Timeline Feel Like an Eternal Wait?

- Step-by-Step Guide to Accelerating Your Claim Process

- Pro Tips for Avoiding Common Roadblocks

- Real-Life Examples of Claims Gone Right (and Wrong)

- FAQs About Hail Insurance Timelines

Key Takeaways

- Delays in hail insurance approvals are often caused by incomplete documentation or unclear policies.

- Submitting all required documents upfront shaves weeks off the Approval Timeline.

- Communicating proactively with adjusters ensures a smoother process.

- Understanding timelines helps set realistic expectations.

Why Does the Approval Timeline Feel Like an Eternal Wait?

I once filed a hail insurance claim thinking it would be wrapped up in two weeks, tops. Boy, was I wrong. What should have been straightforward turned into a month-long ordeal thanks to missing paperwork. Lesson learned.

Here’s why most people experience painfully slow approval timelines:

- Paperwork Overload: Insurers demand everything under the sun—photos, receipts, proof of damage—and missing even one item delays processing.

- Claim Overload: After major storms hit, insurers receive thousands of claims at once. Imagine being just another number in that queue.

- Adjuster Availability: Sometimes it takes ages for an adjuster to arrive because they’re overwhelmed too.

- Policy Confusion: Many policyholders don’t fully understand their coverage and end up submitting incorrect information.

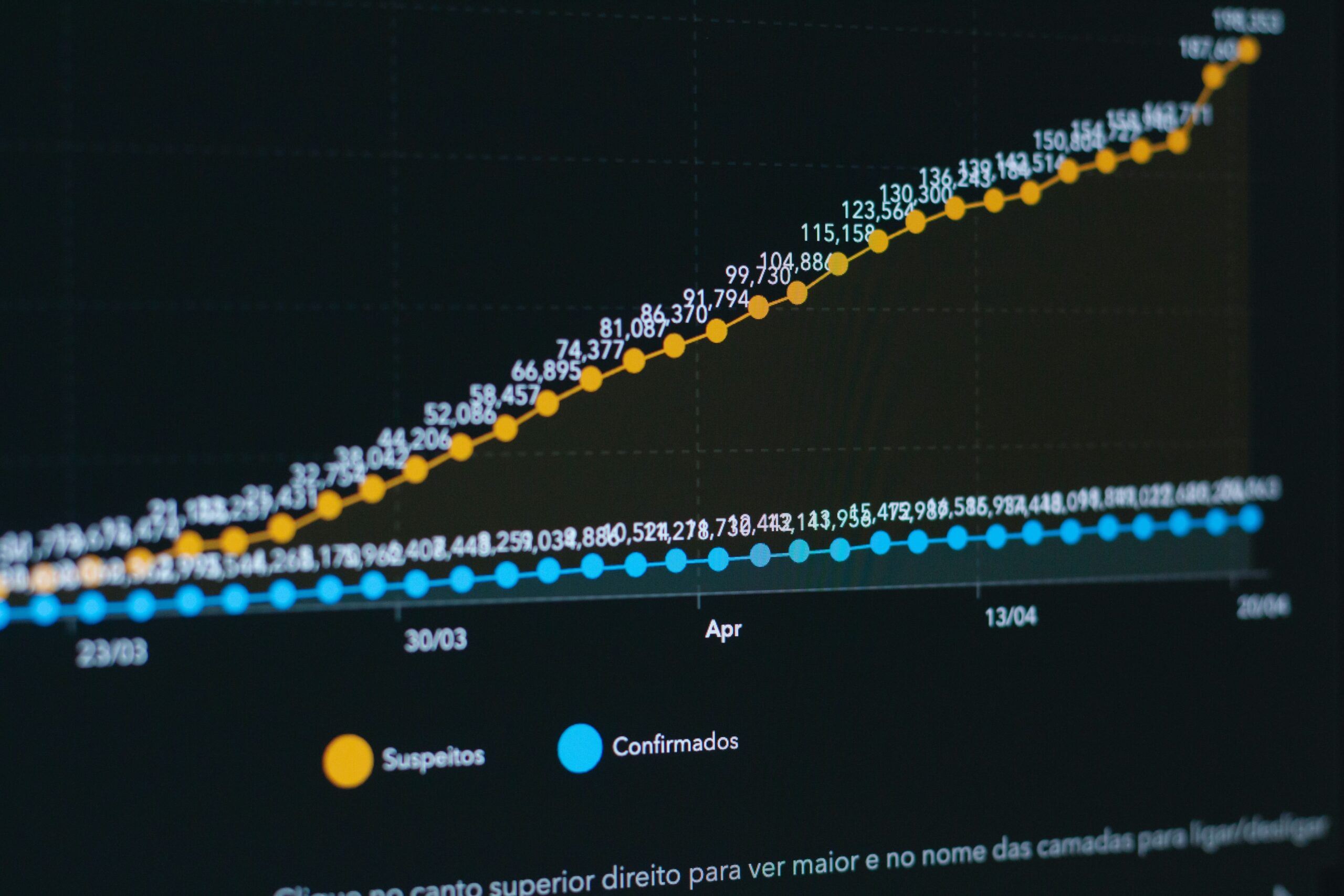

Image: Visualizing how adjustments factor into your overall timeline.

Sounds frustrating, doesn’t it? But fear not—there’s hope ahead.

Step-by-Step Guide to Accelerating Your Claim Process

Optimist You: “Let’s tackle this systematically!”

Grumpy You: “Ugh, do we really have to?” Yes, yes you do. Here’s how:

Step 1: Gather Evidence Immediately

Taking photos right after the storm is key. Capture every angle of the damage before making any temporary fixes. Think Instagram-worthy shots but for disaster recovery.

Step 2: Review Your Policy Thoroughly

Now’s the time to channel your inner Sherlock Holmes. Dive deep into your policy to know exactly what’s covered. This prevents back-and-forth emails later.

Step 3: Submit All Documents Upfront

Create a checklist so nothing gets missed. Include:

- Detailed photos

- Repair estimates

- A copy of your policy declaration page

No one wants to chase ghosts of missing papers haunting their timeline.

Step 4: Stay Proactive During Adjustments

Pick up the phone and call your adjuster weekly. A well-timed check-in keeps things moving without seeming pushy. Bonus points if you sound pleasant instead of desperate.

Pro Tips for Avoiding Common Roadblocks

Here are some quick wins:

- Document Everything: Keep records of all calls, emails, and interactions. Even write down who said what when—trust me, it pays off.

- Use Digital Tools: Apps like Google Drive let you organize evidence neatly. No more scrambling for files five months later.

- Be Realistic: Don’t believe anyone promising instant payouts. Typical Approval Timeline ranges from 30–60 days depending on complexity.

Terrible Tip Alert: Some shady companies promise “instant approval.” Yeah, stay far away unless you want unnecessary stress.

Rant Time: Why Are Policies So Complicated?

Insurance jargon feels designed specifically to confuse mere mortals. Why can’t we get plain English explanations?! Ugh.

Real-Life Examples of Claims Gone Right (and Wrong)

Case Study #1: Sarah submitted her claim within 48 hours of the storm, included thorough documentation, and maintained regular communication with her adjuster. Total timeline? Four weeks flat.

Case Study #2: Mark waited three weeks to file his claim, had blurry photos, and forgot essential docs. His Approval Timeline? Three whole months.

Image: How proactive preparation vs disorganization impacts outcomes.

FAQs About Hail Insurance Timelines

Q: How long does it typically take for hail insurance to approve a claim?

A: Most claims resolve within 30–60 days, provided all necessary info is supplied early.

Q: Can credit cards help during waiting periods?

A: Absolutely! Credit cards offer short-term liquidity while you wait for reimbursements.

Q: Should I hire a public adjuster?

A: It depends. For complex cases, yes; otherwise, DIY works fine with proper effort.

Conclusion

Navigating hail insurance approval timelines might seem daunting, but armed with these strategies, you’ll breeze through like a seasoned pro. Remember: Preparation + Patience = Payoff.

Like burnt toast before coffee, getting started early makes all the difference. Now go conquer that chaotic hail aftermath!

Oh, and here’s a cherry-on-top haiku for you:

Hail hits hard, hope wanes— But timely prep saves the day. Rainbows follow storms.